Safeguarding Success: Bagley Risk Management Services

Wiki Article

How Animals Risk Defense (LRP) Insurance Coverage Can Protect Your Livestock Investment

Animals Risk Protection (LRP) insurance stands as a reputable guard versus the uncertain nature of the market, supplying a strategic approach to guarding your assets. By delving right into the ins and outs of LRP insurance and its multifaceted benefits, animals manufacturers can strengthen their financial investments with a layer of protection that goes beyond market changes.

Understanding Animals Threat Security (LRP) Insurance

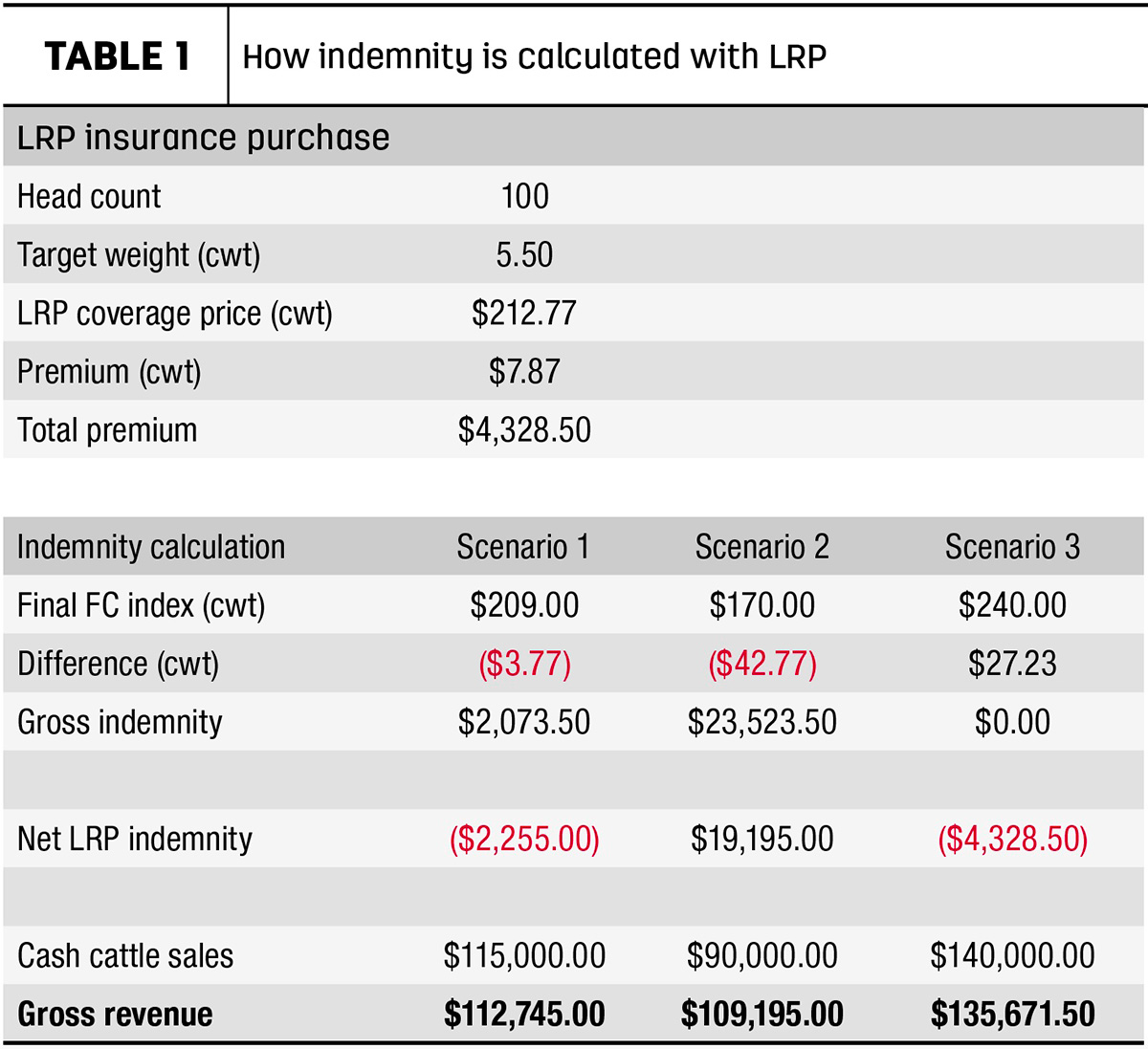

Recognizing Livestock Risk Defense (LRP) Insurance is important for livestock manufacturers looking to minimize financial threats linked with price variations. LRP is a government subsidized insurance product created to safeguard manufacturers against a decrease in market costs. By offering insurance coverage for market cost declines, LRP assists manufacturers secure a floor rate for their livestock, making certain a minimum degree of profits despite market variations.One key element of LRP is its flexibility, enabling manufacturers to customize coverage degrees and plan lengths to fit their details needs. Manufacturers can pick the number of head, weight variety, insurance coverage price, and insurance coverage period that line up with their manufacturing objectives and risk resistance. Recognizing these customizable alternatives is crucial for manufacturers to efficiently handle their price risk exposure.

Moreover, LRP is offered for various livestock types, consisting of livestock, swine, and lamb, making it a functional threat monitoring device for animals producers across different industries. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make informed decisions to protect their investments and ensure monetary security when faced with market unpredictabilities

Advantages of LRP Insurance Policy for Animals Producers

Animals manufacturers leveraging Livestock Threat Security (LRP) Insurance coverage acquire a strategic advantage in shielding their investments from price volatility and safeguarding a steady financial ground in the middle of market unpredictabilities. By establishing a flooring on the price of their animals, producers can minimize the danger of significant economic losses in the event of market downturns.

Furthermore, LRP Insurance policy gives manufacturers with tranquility of mind. Generally, the benefits of LRP Insurance coverage for animals producers are considerable, using an important tool for managing threat and making certain economic safety in an unforeseeable market atmosphere.

How LRP Insurance Mitigates Market Risks

Reducing market risks, Animals Threat Security (LRP) Insurance coverage provides animals producers with a trustworthy guard versus cost volatility and economic uncertainties. By offering security against unforeseen price declines, LRP Insurance aids producers protect their investments and keep monetary security in the face of market variations. This sort of insurance policy enables livestock producers to lock in a rate for their animals at the start of the policy period, guaranteeing a minimum cost degree no matter market changes.

Actions to Safeguard Your Livestock Investment With LRP

In the world of agricultural danger monitoring, implementing Livestock Danger Defense (LRP) Insurance involves a calculated procedure to safeguard investments against market changes and unpredictabilities. To safeguard your livestock investment successfully with LRP, the initial action is to analyze the specific risks your operation faces, such as cost volatility or unforeseen weather condition occasions. Next off, it is critical to study and select a trusted insurance coverage carrier that offers LRP plans customized to your animals and business demands.Long-Term Financial Security With LRP Insurance

Making certain sustaining economic security via the use of Livestock Danger Protection (LRP) Insurance is a sensible lasting method for agricultural manufacturers. By integrating LRP Insurance into their threat administration strategies, farmers can guard their animals investments against unpredicted market changes and unfavorable occasions that can endanger their financial health gradually.One secret advantage of LRP Insurance policy for long-term monetary safety and security is the satisfaction it offers. With a trusted insurance policy in location, farmers can alleviate the monetary risks connected with volatile market problems and unforeseen losses due to aspects such as illness break outs or natural calamities - Bagley Risk Management. This stability permits producers to concentrate on the everyday operations of their animals company without have a peek at this website constant concern concerning prospective financial obstacles

Furthermore, LRP Insurance policy offers an organized approach to handling threat over the long term. By establishing particular insurance coverage levels and selecting appropriate endorsement durations, farmers can customize their insurance coverage intends to align with their monetary goals and take the chance of resistance, ensuring a protected and sustainable future for their animals procedures. Finally, investing in LRP Insurance policy is a positive method for farming manufacturers to achieve long lasting monetary protection and protect their source of incomes.

Conclusion

To conclude, Animals Danger Defense (LRP) Insurance policy is a valuable device for animals manufacturers to minimize market threats and safeguard their investments. By understanding the benefits of LRP insurance coverage and taking steps to execute it, manufacturers can accomplish long-lasting monetary safety and security for their operations. LRP insurance coverage offers a safeguard against price fluctuations and makes sure a level of security in an unforeseeable market setting. It is a smart option for securing animals investments.

Report this wiki page